Overview

WinnCompanies is committed to supporting your financial well-being — today and tomorrow. The WinnCompanies 401(k) Savings Plan with Fidelity helps you prepare for retirement by offering an easy, tax-advantaged way to save for your future financial needs.

Automatic Enrollment

You are automatically enrolled at a contribution rate of 4% after one month of employment if no action is taken on your part. You may change your contributions or opt out at any time by contacting Fidelity at 1-800-835-5097 or logging in to your Fidelity NetBenefits® account online.

Even 1% can make a difference

Use the contribution calculator on the Fidelity NetBenefits website to calculate how much more you could accumulate in your 401(k) account over time by increasing the amount that you contribute from each paycheck. Even 1% more from your pay could make a big difference!

Key Advantages

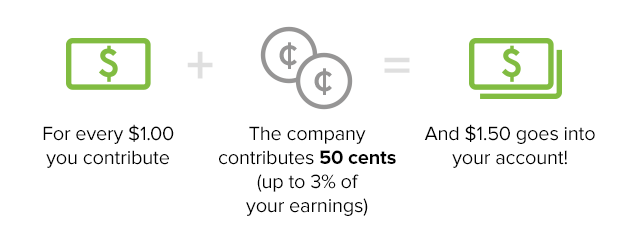

Receive a company match

of 50% of your contributions, up to 3% of your earnings.

Become 100% vested after one year

in all contributions from the company.*

Enjoy current tax savings and tax-deferred

investment growth on pre-tax contributions.

Take tax-free distributions

on Roth post-tax contributions, if you meet certain criteria.

Choose

from a wide range of investment options.

Easily

save for your future through convenient payroll deductions.

*Team members hired prior to January 1, 2025, will not see any change to company contribution amounts vested prior to January 1, 2025.

Manage Your Account

Fidelity NetBenefits® is your one-stop online resource, designed so you can quickly and easily set up, monitor, and manage your retirement account.

- Go to the Fidelity NetBenefits website.

- Click the Register link.

- Follow the instructions to set up your username and password.

Already established a username and password with Fidelity?

- Have you used Fidelity NetBenefits at a previous employer?

- Do you have a brokerage account with Fidelity (or an IRA, mutual funds, or a college savings plan)?

If so, you can use the same login information (username and password) from those accounts to access Fidelity NetBenefits. If you have forgotten your login information, click the Login Help link.

Visit the Fidelity NetBenefits website to conveniently manage your plan account:

- Check your balance.

- Change your contribution rate.

- Manage your investments.

- Update your beneficiary.

- Use planning tools and calculators.

- Access forms and documents.

Your Contributions

You may contribute between 1% and 70% of your eligible pay to your plan account, up to annual IRS limits. In 2025, the IRS limits allow you to contribute up to:

- $23,500 if you are under age 50

- $31,000 if you’re age 50 or older this year (which includes an additional $7,500 in catch-up contributions)

These limits include your pre-tax contributions, Roth post-tax contributions, or a combination of both.

What’s the difference between pre-tax and Roth post-tax contributions?

The WinnCompanies 401(k) Savings Plan gives you the flexibility to save for retirement in a variety of ways. You can make pre-tax contributions, Roth post-tax contributions, or a combination of the two.

Pre-tax contributions

The money goes into your account before taxes are deducted, so you keep more of your take-home pay. Then, you’ll owe taxes on both your contributions and any investment earnings when you withdraw your money in retirement (when you may be in a lower income tax bracket).

Roth post-tax contributions

The money goes into your account after taxes are withheld. Then, both your contributions and any associated earnings can be withdrawn tax-free in retirement.*

*In order for Roth earnings to be withdrawn tax-free, you must meet these two requirements:

- At least five years have elapsed since your first Roth contribution.

- You are at least 59½ or the withdrawal follows death or total disability.

Catch up!

It’s not too late to make up for lost time. If you’ll be 50 or older this year, take advantage of the opportunity to contribute up to an additional $7,500 in 2025.

Company Matching Contributions

To support your retirement saving efforts, WinnCompanies matches 50% of your contributions to the plan when you contribute up to 6% of your eligible earnings, for a company contribution amount that equals up to 3% of your eligible earnings each paycheck.

Here’s how the company match works:

Meet the match!

Are you making your money work as hard as you do? Try to contribute at least 6% to take full advantage of the match — otherwise, you’re saying “no thanks” to free money.

Vesting

Vesting is another way of saying “how much of the money is yours to keep if you leave the company.” You are always 100% vested in your own contributions, including any investment gains and losses on the money. You will be 100% vested in all company contributions after one year of employment.*

*Team members hired prior to January 1, 2025, will not see any change to company contribution amounts vested prior to January 1, 2025.

Have you named a beneficiary?

It's important to designate a beneficiary to receive the value of your 401(k) account in the event you die before beginning to receive your benefit. As personal circumstances change, be sure to keep that information up-to-date. Visit the Fidelity NetBenefits website to add or change a beneficiary.

Check out the Employee Handbook (Winntranet > Departments > Human Resources > Employee Handbook) for more information.

Before investing, carefully consider the funds’ or investment options’ objectives, risks, charges, and expenses. Call 1-800-835-5097 for a prospectus and, if available, a summary prospectus, or an offering circular containing this and other information. Please read them carefully. Investing involves risk, including the risk of loss.